Fair Oaks Reflections – Issue 7

31 May 2019

WHAT IS HAPPENING WITH AAA CLOs?

In this Reflections we explore the reliance of the CLO market on Japanese investors, the underperformance of CLO AAAs compared to other credit products during 2019 year-to-date and recent moves towards a more granular and diverse AAA investor base.

CLO MARKET RELIANCE ON JAPANESE BANKS

We have often highlighted during investor meetings the potential risk to the primary CLO market from a concentrated AAA investor base as a small number of Japanese banks are a key source of financing for the CLO market. Market sources estimate that Japanese banks have purchased over 30% of primary CLO AAAs over the last few years1. In Europe, it is estimated that Japanese buyers accounted for two thirds of primary CLO AAAs in the first quarter of 20192.

These Japanese investors generally have strict documentation demands and limit their investments to a subset of approved managers. CLO managers and arrangers have relied heavily on them given the easier and more certain execution and the tighter AAA spreads they have offered compared to alternative AAA investors.

RISKS TO JAPANESE AAA DEMAND

During the summer of 2018, the Japanese Financial Services Authority (“JFSA”) raised the possibility of capital rule changes which would triple regulatory capital charges (capped at 1250%) for certain securitisations positions that did not comply with a 5% risk retention requirement. The rules, which were published in December and confirmed in March, effectively exempted most CLOs from higher capital charges, subject to certain diligence requirements. Nonetheless, the delay between the initial announcement of the JFSA’s proposal and the final rule generated significant uncertainty in the market.

In addition to the risk retention developments, Japanese CLO investors have also been subject to increased scrutiny by their local regulator, the press and even politicians (see Bloomberg, 18-Apr-19, “Japanese Bank’s $61 Billion CLO Binge Reaches Politicians’ Radar”). The developments in Japan have also been followed by US and European CLO AAA investors, wary of the impact any reduction in Japanese demand could have on market pricing levels.

RECENT PERFORMANCE OF CLO AAAs

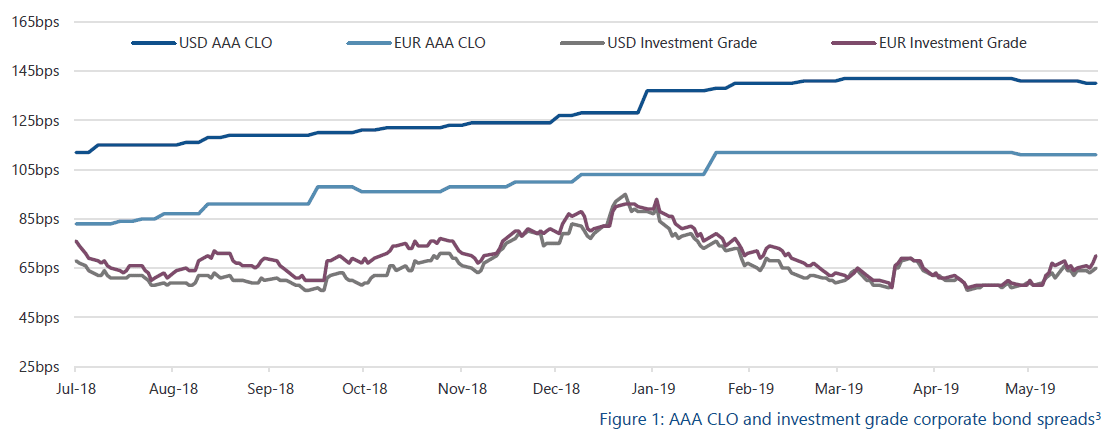

Investment grade corporate credit spreads widened by 20 and 13 bps in Europe and the US respectively in the second half of 2018 while CLO AAA primary spreads widened by 25 and 20 bps respectively3. As Figure 1 shows, CLO AAAs have underperformed in 2019. While investment grade corporate spreads have tightened significantly (19 and 23 bps in Europe and the US respectively), CLO AAA spreads have widened slightly.

RECENT DEVELOPMENTS – INCREASED FOCUS ON SYNDICATION OF AAAs

In recent weeks, an increasing number of new issue CLOs, which in the past may have been placed with a single Japanese investor, have had their AAA notes syndicated to a larger number of buyers. Interestingly, these AAAs have priced in line with AAAs sold to Japanese investors. While the syndication process presents the challenge of negotiating structure and documentation with multiple investors who have different preferences, we believe that it is a positive development for the CLO market.

Besides the obvious benefit of a larger and more diverse AAA investor base which reduces reliance on a small, concentrated group of investors, a further positive outcome should be more efficient pricing. The CLO market was suffering from a two-tier market where those managers on the approved lists of Japanese banks, and willing to agree to certain documentation requests, were able to price their AAA notes at a reduced spread. As more CLOs are syndicated across a larger number of investors, a more efficient spectrum of AAA pricing could emerge based on investors’ assessment of manager and portfolio quality and CLO documentation.

FOOTNOTES:

(1) Source: Japan Times, December 2018.

(2) Source: Bloomberg, March 2019.

(3) Source: JP Morgan. Primary USD – CLO AAA Spread to 3M Libor, Primary EUR – CLO AAA Spread to 6M Euribor, DJ CDX.NA.IG Main On the run (5Yr) CDS Spread Mid and iTraxx Europe Main On the run (5Y) Unfunded CDS Spread Mid.