Fair Oaks Reflections – Issue 3

17 January 2019

US bank loans suffered significant losses in November and December 2018 as a result of changes in interest rate expectations and outflows from ETFs and open-ended loan funds (please see our December issue of Reflections). European loans and US and European CLO spreads widened in sympathy, despite limited trading flows and the lack of negative fundamental news.

Credit fundamentals have not materially changed and we believe the current volatility in the CLO mezzanine market represents an opportunity for investors.

BANK LOAN FUNDAMENTALS

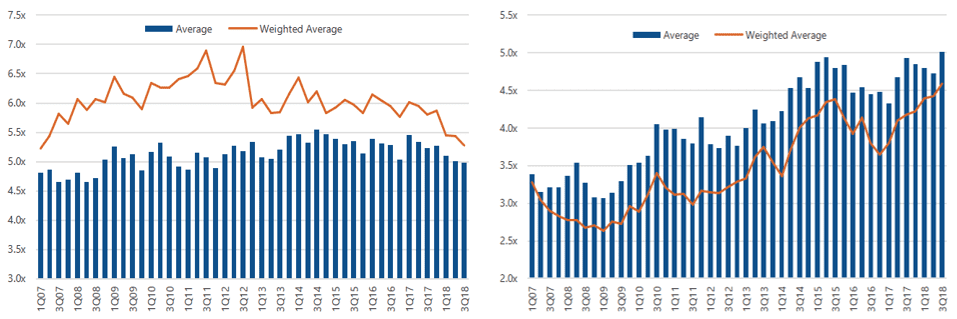

Despite the significant spread widening experienced in December, fundamentals did not materially change in 2018. According to the latest data from S&P Global Intelligence, average leverage for bank loan borrowers decreased in 2018 (Figure 1: Average leverage – S&P/LSTA Loan Index)(1) and interest coverage is at its highest level since 2001 (Figure 2: Average interest coverage – S&P/LSTA Loan Index)(1).

Figure 1 Figure 2

The US loan default rate fell from 2.05% in 2017 to 1.63% in 2018 while the European loan default rate fell from 1.11% in 2017 to 0.11% in 2018(2). US loan managers, on average, expect bank loan defaults to increase to 2.16% by the end of 2019, in line with sell-side research default expectations ranging from 1.50% to 2.50%(3). European loan managers, on average, expect the European loan default rate to increase to 1.68% in 2019(3). In addition to constructive fundamentals, low default expectations are supported by limited amounts of loans set to mature over the next two years (Figure 3)(4).

Figure 3: US leveraged loan maturity profile as at 31-Dec-18(4)

RECENT VOLATILITY IN CLO MEZZANINE MARKETS

We focus our analysis on the US CLO mezzanine market since there is no return index available for European CLO notes but we believe that the absolute and relative performance was similar.

Despite the lack of negative fundamental data or significant trading flows, US CLO mezzanine underperformed bank loans and corporate bonds in December. A and BBB rated US CLOs generated monthly returns of -2.61% and -3.94% in December (Figure 4)(5).

Figure 4: Credit Markets: December 2018 Performance(5)

Unusually, the negative performance of the US high yield market and CLO BBB notes was concentrated on three trading days in December (Figure 5). In particular, the negative performance of the US CLO BBB index on 19-Dec seemed to be driven by the weakness in the US high yield and loan markets during a quiet week, with limited CLO BWIC volumes(6).

Figure 5: Q4-18 daily returns(7)

CURRENT OPPORTUNITY IN CLO MEZZANINE MARKETS

We believe that the market movements suffered by European and US CLO mezzanine notes in December 2018 were not justified by fundamental reasons. CLO mezzanine has recovered part of the losses in January, with the JP CLOIE A and BBB indices up +1.8% and +1.7% respectively, compared to +2.0% for the bank loan index(8) but we believe that current spreads present an attractive investment opportunity.