Fair Oaks Reflections – Issue 11

3 March 2020

In recent days, the spread of Covid-19 and warnings from the World Health Organization, US CDC, and other health agencies have caused investors to reprice risk assets. Although global equity and sovereign debt markets reacted faster to the developments, corporate credit markets have now begun responding to an outbreak that seems increasingly likely to have a widespread economic impact in addition to its significant human costs. This Reflections piece aims to share Fair Oaks’ perspective on the potential impact in bank loan and CLO markets.

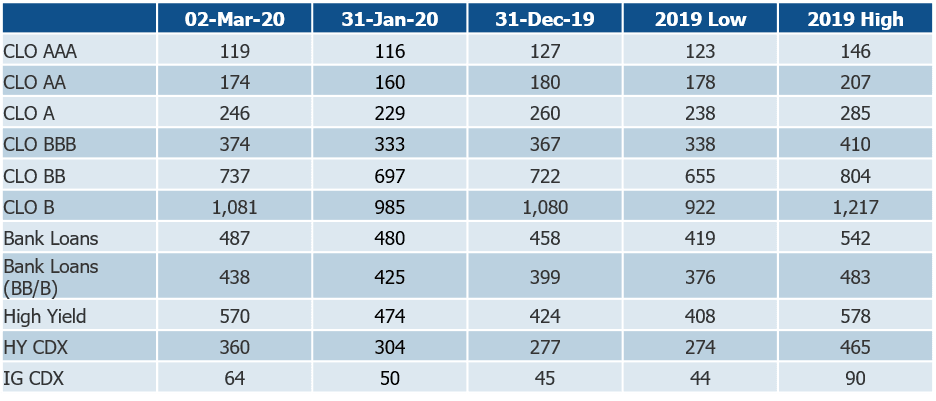

Table 1: Key credit asset spreads1

Impact on bank loan market

A snapshot of recent loan movements by sector for both US and European loan markets illustrates recent market sentiment, with notable underperformance of sectors most likely to be negatively impacted by the virus outbreak.

Table 2: US Loan Index (LSTA) – average loan prices in worst performing sectors in February 20202

Table 3: European Leveraged Loan Index (ELLI) – average loan prices in worst performing sectors in February 20203

Fair Oaks believes that the near-term economic impact could be severe but focused on sectors most exposed to Chinese supply chains and industries reliant on travel and social congregation such as restaurants, sporting and music events, travel providers, and gaming and lodging companies. Over the medium term, disruptions from government-mandated quarantines, school closures and other measures designed to limit the speed or severity of the disease spreading could impact most loan sectors, with some likely exceptions such as utilities and telecommunications.

Impact on CLO market

In response to the risk of fundamental deterioration in the underlying portfolios, we believe that CLO investors should reduce exposure to sub-sectors most at-risk (eg. cyclicals, travel and leisure) and weaker borrower profiles. Fair Oaks will continue to monitor the underlying portfolios and trading activity of its CLO equity and debt investments seek to ensure that managers are reducing risk appropriately.

While borrowers’ liquidity, low near-term maturities and cov-lite documentation make a sharp increase in loan defaults relatively unlikely in the short to medium term, the impact that Covid-19 may have on manufacturing supply chains, travel and leisure industries and consumer confidence will likely lead to an increase in CCC-rated loans. A key concern for CLO investors has been the increasing exposure to B-/B3 loans and an already increasing downgrade/upgrade ratio. Higher CCC exposures in CLOs could result in diversion of cash flow from CLO equity, reducing equity valuations but ultimately supporting CLO debt. We believe that the risk of downgrades of CLO notes is very unlikely in senior notes, and is limited and focused on specific, more aggressive and underperforming transactions for CLO mezzanine notes.

Concerted action by central banks and interest rate cuts will have a mixed impact on CLOs. Short-term, the value of Libor floors should increase, supporting European CLO notes in particular. The floating-rate nature of US CLOs (and loans) may become less attractive for investors, with lower demand affecting prices, as it did in December 2018.

A final factor to consider is the impact of a substantial reduction in primary issuance in the CLO market. The performance of CLO debt in 2019 and early 2020 was, in our view, heavily influenced by primary supply dynamics. A significant reduction in primary supply could act as a key support for the CLO debt market in 2020.

Fair Oaks representative CLO equity strategy – top sector exposures4

Fair Oaks representative CLO mezzanine strategy – top sector exposures5

FOOTNOTES

(1) Source: JP Morgan CLOIE index (discount margin); JP Morgan Leveraged Loan index (discount margin, flat to maturity); JP Morgan BB/B Leveraged Loan index (discount margin, flat to maturity); JP Morgan Domestic High Yield index (spread to worst); CDX IG 5 year (CDS spread mid) and CDX HY 5 year (CDS spread mid)

(2) Source: S&P Global Market Intelligence

(3) Source: S&P Global Market Intelligence

(4) Sectors based on Moody’s classification and CLO subordinated note par weighted exposure. As at 31-Jan-20

(5) Sectors based on Moody’s classification and CLO note par weighted exposure. As at 31-Jan-20