Fair Oaks Reflections – Issue 10

24 October 2019

Despite their strong fundamental performance, CLOs continue to trade at wider spreads than similarly rated corporate bonds or securitised products, particularly in Europe. We believe that complexity, “guilt by association” to CDOs or their hybrid ABS/corporate nature may explain this persistent yield premium but regulatory and policy decisions are also relevant.

In this note we focus on how the treatment of CLOs under the Solvency II directive, their ineligibility for Eurosystem credit operations and exclusion from asset purchasing programs may have impacted spreads negatively.

Fundamental performance and relative value

Low defaults and high historical recovery rates in the underlying collateral (senior secured loans) and the benefits of subordination (see our Reflections 9 for a more detailed discussion), have resulted in CLO historical loss rates well below those of corporate bonds.

Figure 1: Global defaults for all CLOs (cumulative, 1996-2018)1

Figures 2 and 3 illustrate the current relative value offered by CLO notes, when compared with corporate bonds or other ABS securities, across rating categories. European AAA and AA CLOs, for example, offer a gross running yield of 0.9% and 1.7% respectively, compared to 0.3% for the lower rated European BBB corporate index2. The spread offered by CLO notes is also significantly higher than that of similarly rated securitised products.

Figure 2: European corporate bond and CLO yield – relative value3

Figure 3: CLO and selected securitised products – relative value4

Solvency II and STS

The current general regulatory framework in Europe separates securitisations into those which meet certain criteria defined by the Securitisation Regulation (EU) 2017/2402 or “Simple, Transparent and Standardised” (“STS”) Securitisations and those which do not (“non-STS”). STSs generally benefit from a capital treatment similar to that of equally rated corporate bonds. CLOs, despite their historical low default rates, continue to be considered non-STS assets, whereas other securitisations such as SME CLOs or CMBS are able to achieve STS compliance.

Insurance companies in Europe can follow two methodologies when calculating their Solvency Capital Requirements (“SCRs”) under the Solvency II Directive. The first uses internal models to calculate the risk profile of a portfolio and resulting capital requirements while the second follows a standardised approach defined in the regulation. Significant resources are required to develop internal models, which then need to be approved both internally and by regulators. Even when using internal models, insurers are required to run the standard approach in parallel for two years.

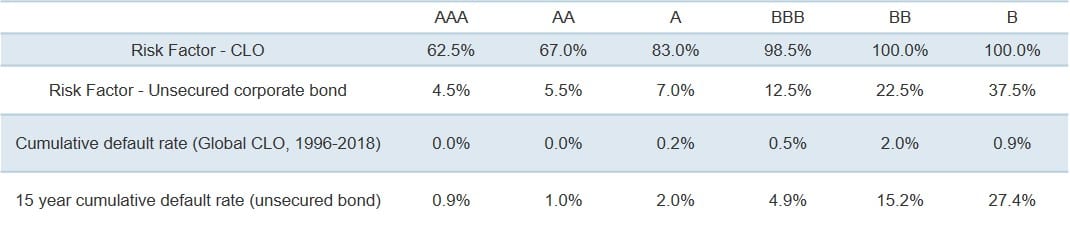

A European insurance company following the standardised approach will treat CLOs as non-STS securitisations, with significantly higher capital charges. To put this in perspective, a portfolio of unsecured B rated corporate bonds (junior to the underlying assets of a typical CLO) currently attracts a 37.5% charge while a AAA rated CLO note backed by senior secured bank loans and protected from losses by 40% worth of junior CLO tranches, is subject to a significantly higher capital charge of 62.5%.

Figure 4: Solvency II Risk Factors for CLOs and Unsecured Corporate Bonds5

According to the latest Bank of England’s Financial Stability report, 5% of global CLO debt is held by European insurance companies. Based on anecdotal evidence, we believe most of these are large, sophisticated insurance companies applying their own internal risk models.

Asset purchasing programs and ECB eligibility

The Asset-backed Securities Purchase Programme (“ABSPP”) was launched in 2014 with the objective to “help banks diversify funding sources and to stimulate the issuance of new securities”. Although ABS purchases ended at the end of 2018, the ECB continues to reinvest principal receipts under the ABSPP programme. As at 20 September 2019, total holdings were €26 billion across AAA, AA and A rated securities6.

While CMBS and SME CLOs, for example, have been included in the programme, CLOs did not benefit directly from the ECB’s demand for ABS. In addition, given that CLOs are also not eligible collateral for Eurosystem credit operations, banks look to other ABS for lowering funding costs in the repo market.

Conclusion

Regulatory changes implemented since the financial crisis, particularly Solvency II, have discouraged European investors from considering CLOs, despite their strong long-term fundamental performance. The ECB’s support for unsecured corporate bonds, commercial lending and other credit assets, through very significant participation in the primary and secondary markets as well as access to attractive repo financing, has created additional demand for corporate bonds and eligible ABS pulling spreads significantly tighter than those of CLOs.

As a result, we believe that CLOs currently offer very attractive relative value and should also be less vulnerable to the withdrawal of quantitative easing and to future regulatory changes.

FOOTNOTES:

(1) Source: S&P Global Ratings, “Default, Transition, and Recovery: 2018 Annual Global Leveraged Loan CLO Default And Rating Transition Study” and “2018 Annual Global Corporate Default And Rating Transition Study”. Average cumulative defaults over 15 years for the period 1981-2018.

(2) Running yield assumes price of par. Based on European primary spreads and JP Morgan European BBB corporate index yield as at 30-Sep-19.

(3) Source: JP Morgan. Current yield for CLOs based on primary CLO spreads and a price of par. European corporate bond yield index, 3-5 year maturities. As at 30-Sep-19.

(4) Source: JP Morgan Primary EUR CLO spreads as at 18-Oct-19, Nomura ABS spreads as at 23-Oct-19

(5) Source: S&P Global Ratings Research, “2018 Annual Global Leveraged Loan CLO Default And Rating Transition Study” and “2018 Annual Global Corporate Default And Rating Transition Study, 1981-2018”

(6) Source: European Central Bank